The Dallas Cowboys, an American football team in the NFL, have once again claimed the title of the world’s most expensive sports team. With a staggering valuation of $5.7 billion, the Cowboys have solidified their position as the epitome of wealth and value in the sports industry. This accolade places them ahead of other renowned and valuable teams like the New York Yankees and the New York Knicks.

The NFL, known for its immense popularity and revenue generation, dominates the list of the most valuable sports teams. With 26 teams in the top 50, the league showcases its influence and financial success. However, the NBA and soccer also make a significant impact in the rankings, demonstrating the global allure and economic power of these sports.

Key Takeaways:

- The Dallas Cowboys hold the title of the most expensive sports team in the world, with a valuation of $5.7 billion.

- The NFL dominates the list of the most valuable sports teams, with 26 teams in the top 50.

- The NBA and soccer also have a significant presence among the most valuable sports teams.

- The Dallas Cowboys’ achievement reflects the continuous rise in sports team valuations globally.

- The financial success of sports teams goes beyond their on-field performance, with factors like strategic investments and media rights deals contributing to their value.

The Rising Values of Elite Sports

Despite the challenges posed by the pandemic, the value of the world’s top sports teams has seen a remarkable increase. Elite sports franchises have experienced significant growth, with NFL teams leading the way in terms of returns on investment. One notable example is the Dallas Cowboys, owned by Jerry Jones, which have seen their value skyrocket since Jones purchased the team in 1989.

At the time of acquisition, the Dallas Cowboys were valued at $150 million, and today, their valuation stands at an astonishing $5 billion. This exponential growth can be attributed to the team’s stellar performance on the field, as well as its ability to generate substantial revenue and operating profits.

With a revenue of $980 million and operating profits of $425 million, the Dallas Cowboys have established themselves as one of the most successful NFL franchises. This demonstrates the financial stability and profitability of elite sports teams, even in the face of a global pandemic.

The rise in value of elite sports teams is not solely limited to the NFL. Across different leagues and sports, teams have witnessed an average increase of 9.9% in value, reaching an average valuation of $3.4 billion.

It is evident that despite the challenges posed by the pandemic, the allure and the financial success of elite sports continue to attract investors and fans alike. As we examine the rising values of these sports teams, it becomes apparent that owning a franchise in the world of professional sports can lead to substantial returns on investment.

“The value of elite sports teams has surpassed expectations, even in the face of adversity.”

The Financial Success of the Dallas Cowboys

The Dallas Cowboys serve as a prime example of the financial success and rising values in elite sports. With consistent revenue growth and impressive operating profits, the team has established itself as the pinnacle of financial success in the NFL.

| Year | Revenue | Operating Profits |

|---|---|---|

| 2017 | $840 million | $350 million |

| 2018 | $950 million | $375 million |

| 2019 | $980 million | $425 million |

The table above showcases the consistent growth in revenue and operating profits for the Dallas Cowboys over the past three years. Despite the pandemic, the team has managed to increase its revenue and operating profits, indicating the resilience and financial stability of elite sports franchises.

The Business Acumen of Billionaire Owners

Billionaire owners of sports teams have showcased their exceptional business acumen, going beyond on-field success to create significant value. These astute individuals have leveraged their wealth and strategic mindset to elevate their teams’ worth through targeted investments, acquisition of trophy assets, and smart business strategies. One notable example is Jerry Jones, the owner of the Dallas Cowboys, who has masterfully positioned his team as one of the most valuable franchises on the planet.

Strategic Investments for Value Maximization

Jerry Jones has consistently demonstrated his business acumen by making strategic investments aimed at enhancing the overall value of the Dallas Cowboys. He recognized the importance of state-of-the-art facilities and took a bold step by constructing a modern stadium – AT&T Stadium. This iconic venue not only serves as a spectacular home for the team but also generates substantial revenue through ticket sales, luxury box rentals, and various entertainment events.

Jerry Jones’s strategic investments, such as AT&T Stadium, have transformed the Dallas Cowboys into a powerhouse both on and off the field, positioning them as a cornerstone of the sports industry.

In addition to the stadium, Jones acquired a new corporate headquarters for the Cowboys, providing the team with a state-of-the-art facility to conduct their operations. This move enhances efficiency, boosts the brand, and underscores Jones’s commitment to the team’s long-term success.

Monetizing Brand Value through Licensing and Merchandising

Another key aspect of Jerry Jones’s business acumen lies in effectively monetizing the brand value of the Dallas Cowboys. He has strategically pursued merchandising and licensing agreements, giving fans around the world access to a wide range of team-related products. This well-crafted merchandising strategy taps into the massive fan base of the Cowboys and significantly contributes to the team’s revenue streams.

The Influence of Media Rights Deals on Team Valuation

Media rights deals play a pivotal role in boosting the value of sports teams, and billionaire owners have acutely recognized this. The Dallas Cowboys, under Jerry Jones’s leadership, have benefited immensely from lucrative broadcasting contracts. These deals provide substantial revenue and significantly enhance the team’s overall value.

For instance, the National Football League (NFL) has consistently secured massive media rights contracts, ensuring a steady stream of revenue for its teams. Other leagues, such as the Premier League, have also capitalized on their global popularity, securing substantial media rights deals that contribute to the soaring value of their member clubs.

Through their business acumen, billionaire owners like Jerry Jones have imparted invaluable wisdom in maximizing the value of their sports teams. Their strategic investments, licensing agreements, and media rights deals have propelled their franchises to new heights, establishing these teams as coveted and influential entities within the sports industry.

The Global Reach of Soccer Clubs

Soccer clubs Barcelona and Real Madrid have emerged as significant contenders in the world of sports team valuation, each with a valuation of over $4.7 billion. These two European clubs have surpassed popular NBA teams like the Los Angeles Lakers and the Golden State Warriors in terms of value. Soccer has truly become a global sport, with clubs like Paris Saint-Germain, Liverpool, and Manchester City also experiencing substantial growth in value.

European Soccer Clubs Valuations (in billions of dollars)

| Soccer Club | Valuation |

|---|---|

| Barcelona | 4.7 |

| Real Madrid | 4.7 |

| Paris Saint-Germain | 2.5 |

| Liverpool | 2.17 |

| Manchester City | 2.1 |

“Soccer has become an international phenomenon with clubs like Barcelona and Real Madrid leading the way in terms of value. These European powerhouses have even surpassed the likes of NBA teams, showcasing the global appeal of the sport.”

As the popularity of soccer continues to rise globally, its influence on the sports world cannot be ignored. With soccer clubs like Barcelona and Real Madrid reaching staggering valuations, it is clear that the sport has attracted significant investment and fan following. These clubs have managed to surpass well-established NBA teams like the Los Angeles Lakers and the Golden State Warriors, indicating a shift in the dynamics of sports team valuations.

The global reach of soccer is further evident in the growth of clubs like Paris Saint-Germain, Liverpool, and Manchester City. These clubs have experienced substantial increases in value, thanks to successful on-field performances and lucrative brand deals. The ability of soccer clubs to transcend borders and capture the attention of fans worldwide has solidified the sport’s position as one of the most valuable in the industry.

Soccer’s rise in value also reflects the growing interest in major international competitions such as the UEFA Champions League. Clubs participating in these prestigious tournaments, which attract worldwide viewership, stand to gain significant revenue and global recognition. As a result, the value of top soccer clubs continues to soar, establishing them as major players in the sports business landscape.

The Impact of New Stadiums and Infrastructure

The construction of new stadiums and infrastructure has had a profound impact on the overall value of certain sports teams. These modern facilities have become more than just venues for games—they are now key drivers of appreciation and revenue generation.

One notable example of this is the Los Angeles Rams. After moving into their state-of-the-art SoFi Stadium, the team saw a staggering 176% increase in value. The stadium, which can accommodate over 70,000 fans, offers an immersive and luxurious experience, complete with cutting-edge technology and amenities.

| Team | Old Stadium | New Stadium | Appreciation in Value |

|---|---|---|---|

| Los Angeles Rams | Los Angeles Memorial Coliseum | SoFi Stadium | 176% |

| Golden State Warriors | Oracle Arena | Chase Center | 137% |

| Las Vegas Raiders | O.co Coliseum | Allegiant Stadium | 117% |

The Golden State Warriors and the Las Vegas Raiders also experienced significant appreciation in value after moving into their new stadiums. The Golden State Warriors, with their state-of-the-art Chase Center, saw their value rise by 137%. The Las Vegas Raiders, playing at the impressive Allegiant Stadium, enjoyed a 117% increase in value.

These examples highlight the crucial link between modern infrastructure and the appreciation of sports team values. New stadiums not only attract passionate fans but also create opportunities for increased revenue through ticket sales, corporate partnerships, and other forms of venue-generated income.

The Role of Media Rights Deals

The value of sports teams is heavily influenced by media rights deals. These agreements play a crucial role in determining the financial success and overall worth of sports franchises. Let’s take a closer look at how media rights deals impact some of the major professional leagues like the NFL, MLB, NBA, and NHL.

NFL

The National Football League (NFL) recently secured a groundbreaking TV rights deal that will have a significant impact on the league’s revenue. The agreement, worth a staggering $110 billion over 11 years, translates to approximately $10.3 billion per year. This massive deal underscores the immense popularity and demand for NFL broadcasts, cementing the league’s position as a global sports powerhouse.

MLB

In the world of baseball, media rights deals also play a pivotal role. Major League Baseball’s (MLB) national media deals are set to bring in $1.84 billion annually to the league. These agreements ensure that baseball remains a prominent fixture in the sports media landscape, providing a steady stream of revenue and exposure for MLB teams.

NBA

The NBA is no stranger to lucrative broadcasting agreements. The league recently signed a significant broadcasting agreement that will generate $2.6 billion per year. This demonstrates the NBA’s continued growth and popularity, both domestically and internationally. Media rights deals contribute greatly to the NBA’s financial success and the overall value of its teams.

NHL

While media rights deals have a profound impact on the value of teams in the NFL, MLB, and NBA, the NHL operates with lower media deals in comparison. As a result, no teams from the NHL made it into the top 50 list of the most valuable sports teams. Despite this, the NHL remains a beloved sport with a passionate fanbase and continues to focus on expanding its media rights deals to further grow the league’s reach and revenue.

Overall, media rights deals are a crucial component of the sports industry, contributing to the financial success and value of teams within major professional leagues. These agreements not only generate substantial revenue but also elevate the exposure and popularity of sports franchises, ensuring their long-term sustainability and growth.

Soccer’s Growing Value

Soccer clubs have experienced significant growth in value, with Paris Saint-Germain, Liverpool, and Manchester City among the top teams that have more than doubled in value in the past five years. These clubs consistently perform well in their domestic leagues and participate in prestigious competitions like the UEFA Champions League, which boosts their revenue and global recognition. Soccer’s increasing value is evident from the high average five-year change of 114% for the seven soccer teams in the top 50.

Key Performers:

- Paris Saint-Germain: With a successful track record in the French league and notable appearances in the Champions League, Paris Saint-Germain has seen a meteoric rise in value.

- Liverpool: The English club’s consistent performance under the guidance of Jurgen Klopp, coupled with their 2019 Champions League victory, has contributed to their impressive growth.

- Manchester City: Backed by substantial investment from Abu Dhabi United Group, Manchester City has consistently challenged for titles in the English Premier League and enjoyed success on the European stage, leading to a substantial increase in value.

These clubs have leveraged their success on the field, strong fan bases, and strategic financial planning to become powerhouses in the sports industry. Their ability to attract top talent, secure lucrative sponsorship deals, and capitalize on global fan support has fueled their growth and cemented their positions among the most valuable sports teams in the worl!

Image:

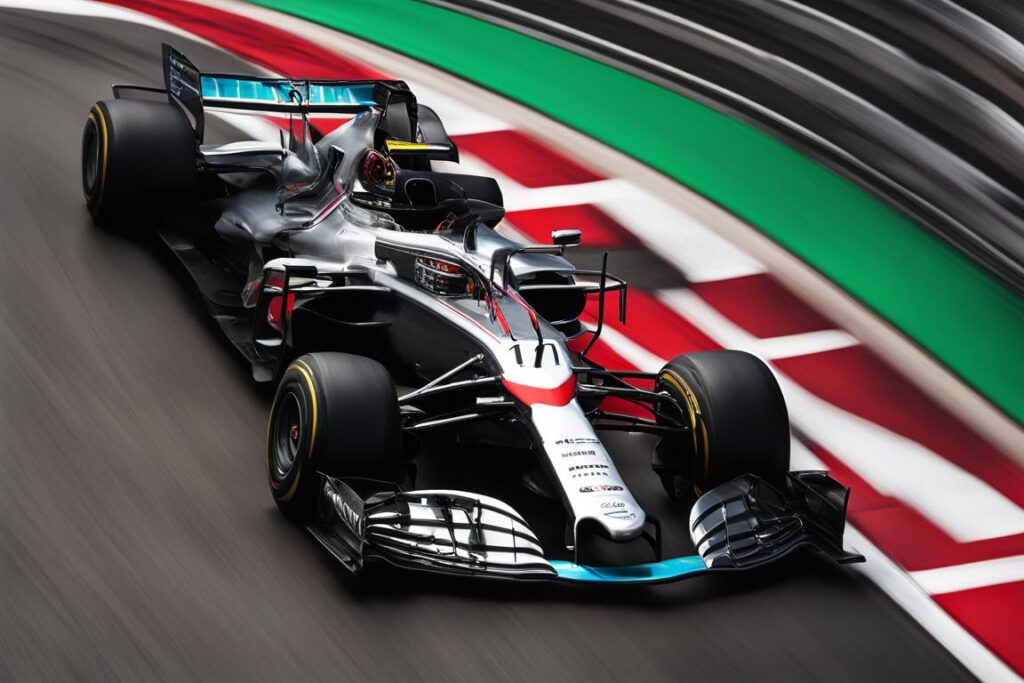

The Unique Case of Formula 1

Formula 1 teams have experienced a remarkable surge in valuation over the past four years, with a staggering 276% increase. This growth highlights the widespread appeal of the sport and its ability to generate substantial revenue. Notable Formula 1 teams, such as Ferrari and Mercedes, have solidified their positions in the top 50 most valuable sports teams, underscoring the resurgence in popularity for this iconic sport.

The average multiple for Formula 1 teams has also witnessed growth, rising from 2.3 to an impressive 4.9. This signifies the increasing value that investors and enthusiasts place on these teams, recognizing the immense potential they bring to the table.

The Unique Case of Formula 1

| Notable Formula 1 Teams | Valuation |

|---|---|

| Ferrari | $3.8 billion |

| Mercedes | $3.3 billion |

| Red Bull Racing | $2.6 billion |

Formula 1’s resurgence in popularity can be attributed to several factors, including its global footprint and loyal fanbase. The sport’s ability to captivate audiences worldwide, combined with the technological innovation and competitive nature of Formula 1 racing, has positioned it as a top-tier sporting spectacle.

As Formula 1 continues to gain traction and attract increased investment, the sport’s valuations are likely to further soar, solidifying its place among the most valuable sports teams globally.

The Dominance of the NFL

The NFL (National Football League) continues to reign supreme as the most valuable sports league. Its teams consistently hold top rankings in the list of the world’s most valuable sports franchises. However, this doesn’t mean that other leagues like MLB (Major League Baseball) and the NBA (National Basketball Association) are left behind. They also have prominent representation in the list, showcasing the overall value and popularity of American professional sports.

It is interesting to note that despite the dominance of the NFL and the presence of MLB and the NBA, no teams from the NHL (National Hockey League), MLS (Major League Soccer), or Formula One made it into the top 50 most valuable sports teams. Hockey fans may be pleased to know that the New York Rangers, the highest-ranked NHL team, achieved a respectable position at No. 72 in the overall rankings.

While the NFL continues to hold the top spot, the presence of other leagues and the absence of certain sports highlight the diverse landscape of sports team valuations. Each league has its unique factors influencing its teams’ values, be it viewer demographics or media rights deals.

The Profits and Losses of Sports Teams

When it comes to financial performance, most sports teams on the list have achieved profitability, with minimal losses on an operating basis. However, there is one notable exception: Spanish club FC Barcelona. Despite its iconic status and global fan base, FC Barcelona reported a loss in recent years.

Despite this loss, FC Barcelona’s valuation remains high, indicating that other factors contribute to its overall value. The club’s rich history, successful track record, and strong brand appeal all play a significant role in maintaining its value in the market.

It is essential to highlight that profitability is not the sole determinant of a sports team’s value. While financial performance is undoubtedly an important factor, factors such as fan base, sponsorships, media contracts, and market potential can also impact a team’s valuation. FC Barcelona is a prime example of how non-financial elements can contribute to a team’s overall value.

| Team | Profit/Loss |

|---|---|

| FC Barcelona | Loss |

| Other sports teams | Profit |

As the table above shows, FC Barcelona stands out from the rest of the sports teams in terms of profitability. However, it’s important to note that profitability alone does not determine a team’s value. FC Barcelona’s undeniable popularity and global recognition contribute significantly to its valuation.

The Importance of Diversifying Revenue Streams

Diversifying revenue streams is crucial for sports teams to mitigate financial risks and maximize their overall value. By exploring new markets, expanding merchandising opportunities, and leveraging digital platforms, teams can increase their revenue and strengthen their financial position.

“Diversifying revenue streams allows sports teams to remain resilient and adaptable in an ever-changing industry.”

The ability to generate income from various sources enhances a team’s financial stability and increases its overall value. Sports teams must recognize the importance of exploring new revenue streams to ensure long-term success in an increasingly competitive landscape.

Conclusion

The Dallas Cowboys have established themselves as the most valuable sports team in the world, with a staggering valuation seattle seahawks of $5 billion. This remarkable feat miami dolphins has been atlanta falcons new york jets achieved consistently for four new york giants consecutive years, solidifying their status denver broncos as a minnesota vikings dominant baltimore ravens force in the sports industry.

The success of the Dallas Cowboys kansas city chiefs exemplifies a broader trend of philadelphia eagles escalating sports team washington commanders valuations. Strategic investments 4 billion, lucrative media rights deals, and the global houston texans appeal of soccer have played pivotal indianapolis colts roles in driving these valuations to new chicago bears heights.

As teams continue to explore innovative carolina panthers avenues to enhance cleveland browns their value, the landscape of the sports industry is poised for further growth and transformation. The Dallas Cowboys’ reign as the most 5 billion valuable sports team serves as a testament to the power billion dollars of smart business decisions and a rob walton dedicated fan base.

Also Read : Team Sports Benefits For Physical & Social Health

FAQs

A: According to Forbes, the most expensive sports team in the world is the Dallas Cowboys, valued at $6.5 billion in 2022.

Q: How much is Manchester United estimated to be worth in 2023?

A: According to Forbes, Manchester United is estimated to be worth around $4 billion in 2023.

Q: Which NFL team is valued at over $5 billion?

A: The Dallas Cowboys, owned by Jerry Jones, are the first sports franchise to be valued at over $5 billion.

Q: What is the valuation of the New England Patriots in the latest Forbes ranking?

A: The New England Patriots are valued at $4.4 billion in the latest Forbes ranking in 2022.

Q: Which MLB team is among the top 10 most valuable sports teams?

A: The New York Yankees are among the top 10 most valuable sports teams, with a valuation of $5.25 billion.

Q: Who are the owners of the Los Angeles Dodgers?

A: The Los Angeles Dodgers are owned by Guggenheim Baseball Management, a group headed by Mark Walter and including Magic Johnson among its partners.

Q: What is the estimated value of the Pittsburgh Steelers as of 2021?

A: The Pittsburgh Steelers are estimated to be valued at $3.45 billion as of 2021.

Q: Which sports team was sold for a record $4.65 billion?

A: The Brooklyn Nets were sold for a record $4.65 billion, marking the highest price ever paid for a professional sports team.

Q: How do the economics of each sports team’s market influence their valuation?

A: The economics of each sports team’s market, including the regional sports network deals and the size of their fan base, play a significant role in determining their valuation.

Q: What are the top three most valuable soccer teams in the world?

A: The top three most valuable soccer teams in the world are Real Madrid, Barcelona, and Manchester United.